Dos and Don'ts

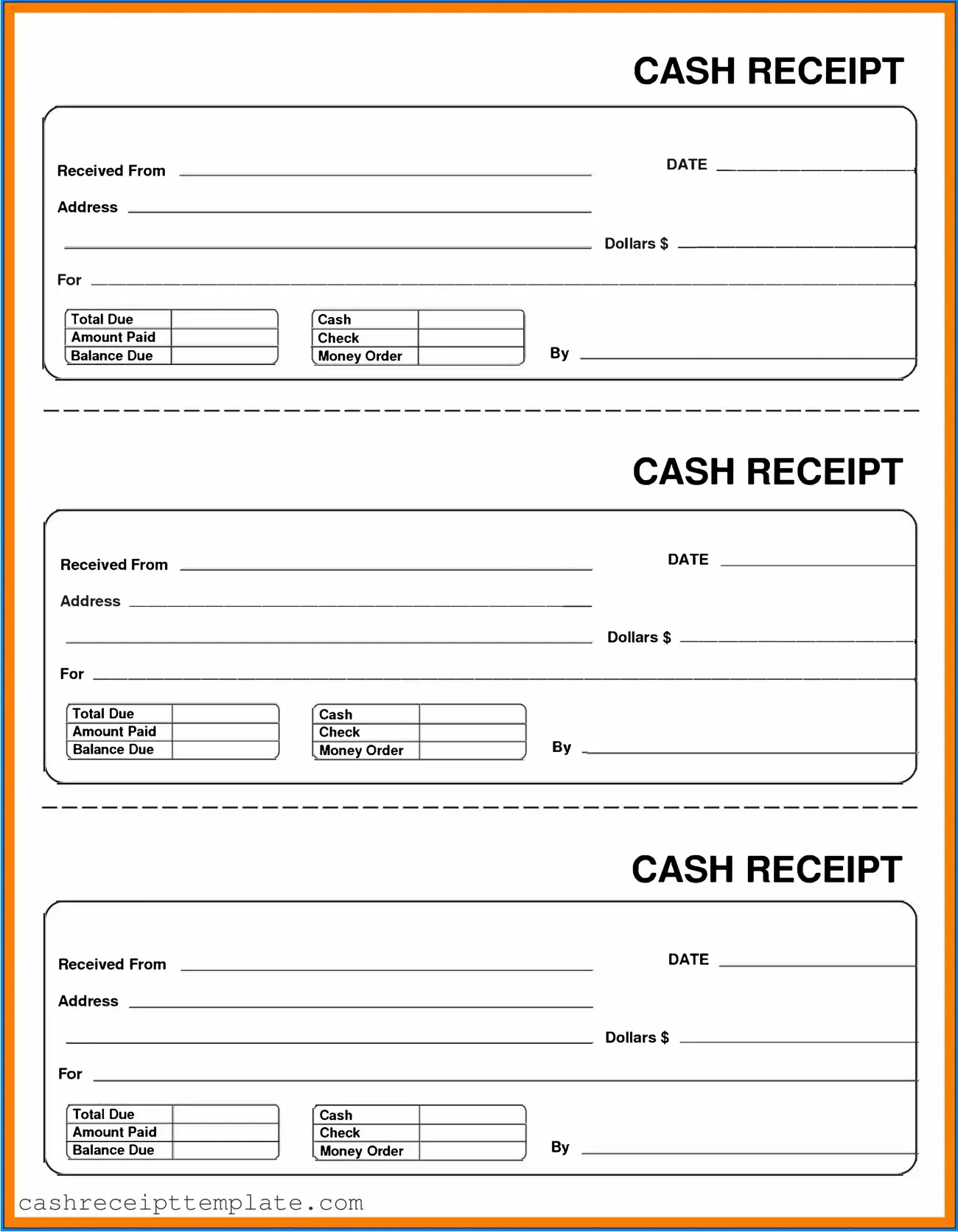

When filling out the Cash Receipt form, it is essential to approach the task with care and attention to detail. Here are some important dos and don'ts to consider:

- Do ensure that all information is accurate and complete before submission.

- Do use clear and legible handwriting or type the information to avoid any misunderstandings.

- Do double-check the amount received to ensure it matches the payment.

- Do sign and date the form to validate the transaction.

- Do keep a copy of the Cash Receipt for your records.

- Don't leave any sections blank; fill out every required field.

- Don't use correction fluid or tape to alter any information on the form.

- Don't forget to include any necessary supporting documentation.

- Don't submit the form without reviewing it for errors.

- Don't ignore the guidelines provided for completing the form.